Nigeria's Monetary Growth: A Closer Look At The Numbers

Monetary Expansion in Nigeria: February 2025 Highlights

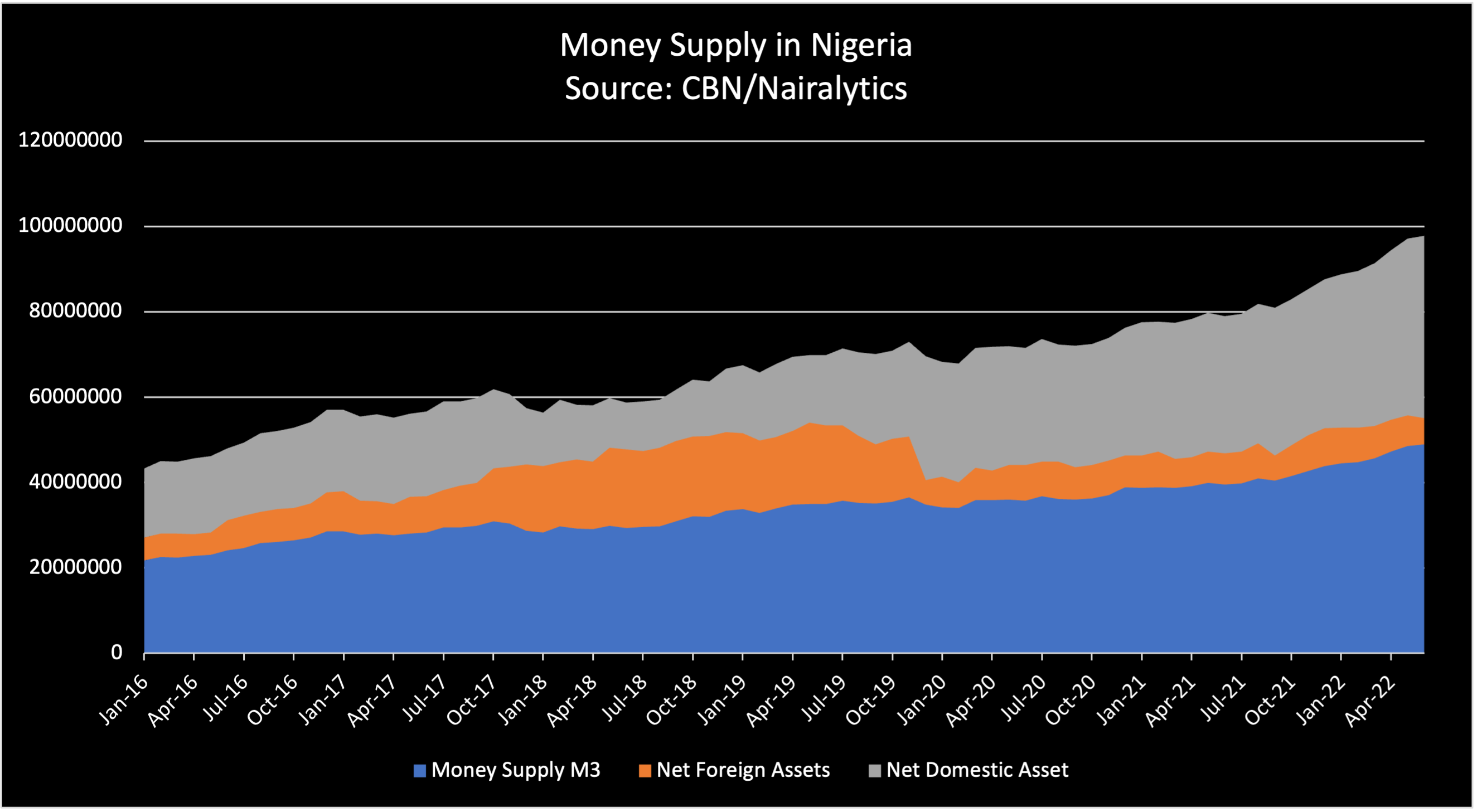

Let’s talk about what’s happening with Nigeria’s money supply. According to the Central Bank of Nigeria (CBN), there’s been a substantial 17.3% year-on-year increase in the country’s money supply (M2). This figure climbed to an impressive ₦110.3 trillion in February 2025, up from ₦93.97 trillion the same time last year. The CBN recently released this information in their Money and Credit Statistics report, shedding light on the financial landscape of the nation.

What’s Driving the Numbers?

Now, let’s break it down. The report from Naija News points out that while the money supply is growing, there’s been a bit of a dip in credit to the economy. Specifically, credit to the economy dropped by 13.4% year-on-year, settling at ₦99.4 trillion in February 2025. This decline is largely attributed to reduced lending to both the government and the private sector. But don’t worry, we’ll dive deeper into that later.

What’s really pushing this growth in the money supply? Well, it’s the favorable changes across the various components of the money supply that are making the difference. For instance, quasi-money, which includes savings deposits, time deposits, and other near-money assets, saw a 14% year-on-year increase, rising to ₦72.7 trillion from ₦63.7 trillion in February 2024. That’s a pretty significant jump, right?

Read also:Andrew Niccols Net Worth In 2024 A Look Into His Film Success And Financial Insights

Demand Deposits and Currency Outside Banks

And it doesn’t stop there. Demand Deposits experienced a remarkable 22.8% year-on-year surge, reaching ₦33.05 trillion in February 2025, compared to ₦26.9 trillion in February 2024. Not to be outdone, currency outside banks also saw a notable increase of 32% year-on-year, climbing to ₦4.51 trillion in February 2025 from ₦3.41 trillion in February 2024.

When we look at narrow money (M1), it too showed growth, increasing by 21.7% year-on-year, reaching ₦36.9 trillion in February 2025, up from ₦30.3 trillion in February 2024. A big part of why we’re seeing this rise in the broad money supply (M2) is because of the government borrowing more from the domestic market.

Credit to the Government and Private Sector

According to the CBN, credit extended to the government amounted to ₦26.5 trillion in February, reflecting a 21.8% year-on-year decrease from ₦33.92 trillion in February 2024. However, if we zoom in on a month-on-month basis, credit to the government actually increased by 8% from ₦24.5 trillion in January 2025.

On the flip side, credit to the private sector experienced a year-on-year decrease of 7.4%, dropping to ₦74.9 trillion in February 2025 from ₦80.9 trillion in February 2024. Moreover, there was a month-on-month decline of 1.6% in credit to the private sector, falling from ₦74.9 trillion in January 2025.

The Bigger Picture

When we put all the pieces together, it leads to a 13.4% year-on-year reduction in total credit to the economy, which decreased to ₦99.4 trillion in February 2025, compared to ₦114.8 trillion during the same period in 2024. This paints a complex picture of Nigeria’s financial health, with both positive and negative indicators. Understanding these dynamics is crucial for anyone looking to grasp the economic pulse of the nation.

Osun State Takes Action: Holding Camps For Displaced Residents

TikToker 'Tumma' Trial Postponed: Police Unable To Produce Him In Court

Former NYSC DG Held For 49 Days Despite Ransom Payment